According to Business Insider Singapore in May 2018, there are

28 banks in the world with $1 trillion of asset each. Of that, China is

home to the four largest in the world by asset ranked in the following order:

1.

Industrial & Commercial Bank of China (ICBC)-

$4.0 trillion (SHA: 601398, HKG: 1398, US: IDCBY)

2.

China Construction Bank (CCB) - $3.4 trillion (SHA:

601939, HKG: 0939, US: CICHY)

3.

Agricultural bank of China (ABC) - $3.24 trillion

(SHA: 601288, HKG: 1288, US: ACGBY)

4.

Bank of China (BOC) - $2.99 trillion (SHA: 601988,

HKG: 3988, US: BACHY)

Collectively known as Big Four banks in China, their A-shares

and H-shares dual-listed in China and Hong Kong stock markets and ADR shares are available for trading in US market too. These bank

stocks had a good run since bottoming in early 2016, clocking gains of between

80% to 120% from their lows. After peaking in Jan 2018, their share prices have

correct almost 20%. With low Price-earnings ratios and high dividend yields currently, are they good bargains to buy now?

|

| Click to enlarge |

Based on the price as of 22 Aug 2018, the valuation matrices

based on Price-earnings ratios (P/E), Price-book ratios (P/B) and dividend yields

are as follow:

At a glance, it appears that BOC is the cheapest (lowest

PE, highest dividend yield) among the four followed by ABC while

ICBC and CCB are trading at very close valuations.

Before deciding on which bank is the best bargain right away,

the analysis might be useful to compare the banks in terms of

profitability, asset quality and capital adequacy based on their 2017

annual results.

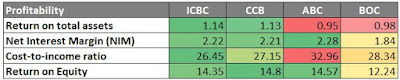

Comparison

of Profitability

Based on the above profit indicators, ICBC and CCB scored

the best. Although ABC was the best in terms of NIM (i.e. difference between Interest

Income and Interest Expense over Total value of Loans and Securities), it also

had the highest cost-to-income ratio (expenses incurred to earn that income)

and lowest return on total assets. However, ABC managed to earn relatively

higher Return on Equity (ROE), probably due to the lower common equity employed

which could be seen from the section on Capital Adequacy. Of the four, BOC had

the lowest ROE.

Comparison

of Asset Quality

A non-performing loan (NPL) is defined as a loan that is in

default or close to being in default. High NPL ratio may indicate that greater

portion of loans were made to poor credit quality borrowers. Allowance to NPL is

the amount provision made divided by the amount of NPL. A higher Allowance to

NPL indicates a bigger buffer and hence ability to absorb any sudden increase

in the NPL without immediate impact on the future profits.

From the table above, it can be seen that ABC had the

highest NPL ratio and was the most aggressive in terms of making provision for the

potential impairment losses on loans and CCB seems to be in the middle of the

extremes.

Comparison of Capital Adequacy

According to Investopedia, the Capital Adequacy Ratio (CAR)

is a measure of a bank's available capital expressed as a percentage of a

bank's risk-weighted credit exposures. Tier one capital is the capital that is

permanently and easily available to cushion losses suffered by a bank without

it being required to stop operating.

As tabulated, CCB and ICBC had the highest capital adequacy

ratios. While ABC had the lowest ratios, it may be useful to note that BASEL

III international regulatory framework only requires 8.5, 9.5 and 11.5 for the

above ratios (source DBS Research) and

all the four banks were well in excess of the minimum requirements.

From the P/B and ROE chart above, it can be deduced that the

market is currently pricing the four PRC banks based on profitability, quality

of assets and adequacy of capital with CCB having the highest valuation awarded,

followed by ICBC, ABC and BOC in that order.

Would you pick the cheapest bank to invest or pay a higher

price for better quality?Due to lingering fears of hidden bad loans, China banks have persistently traded at low PEs and below its book values over the past few years despite providing relatively high dividend yield.

Other articles on Banks:

Who Had Been Buying and Selling the Shares of Singapore Banks?

Connect @ Facebook

This is not a buy or sell recommendation. Please do your own due diligence before making any investment decision. Read Disclaimer

This is not a buy or sell recommendation. Please do your own due diligence before making any investment decision. Read Disclaimer