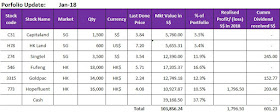

The opening month of 2018 saw quite a bit of activities in this portfolio, with two new stocks added, increased exposure in one current holding and partial profit taking in another.

Higher cash amount had been deployed and the cash position fell to below 40% of total portfolio.

Higher cash amount had been deployed and the cash position fell to below 40% of total portfolio.

Transactions done in Jan 18:

1. CapitaLand Limited

1. CapitaLand Limited

Initiated new position.

CapitaLand Limited is one of the Asia's largest real estate companies based in Singapore. Quick analysis of the company can be found HERE.

With the expected pick up in the economies around Asia, property sector may be one of the beneficiaries. Singapore private property market which has been subject to Government's cooling measures has also shown signs of improving sentiments. While China residential property market has also been under Government's control measures, share prices of property stocks have rallied strongly recently on sales optimism and expectation on relaxation of cooling measures.

CapitaLand, having strong presence in both markets (83% of total assets), has been trading near multi-year low valuation in terms of PE and Price over book value. Moreover, CapitaLand has been growing its recurring income from investment properties (85% of total assets are contributing to recurring income as at Sept 17) and have recently increased its dividend payout which appears to be sustainable.

With improving outlook and sentiment, CapitaLand could trade closer its historical mean of 1 to 1.1x its book value which is currently at $4.29 as at Sep 17, i.e. fair value of $4.29 to $4.70.

At the purchased price, dividend yield of 2.7% is pretty decent.

Risks:

1. Property business, especially residential property development can be quite cyclical, subject to the health of the economy as well as Government's policies.

2. Rising interest rates might increase the financial burdens of property companies with high gearings, adversely affect capitalization rates used for property valuations and dampen buyers' appetite for properties.

2. Hongkong Land Limited

Initiated new position.

The investment thesis for Hongkong Land is almost the same as CapitaLand, at current price, HK Land is trading at huge discount to its book value of more than 50%, dividend yield of about 2.7%.

Founded in 1889, Hongkong Land is a listed leading property

investment, management and development group.

The Group owns and manages almost 800,000 sq. m. of prime office and

luxury retail property in key Asian cities, principally in Hong Kong and

Singapore.

Its

Hong Kong Central portfolio represents some 450,000 sq. m. of prime property.

It has a further 165,000 sq. m. of prime office space in Singapore mainly held

through joint ventures, and a 50% interest in a leading office complex in

Central Jakarta. The Group also has a number of high quality residential and

mixed-use projects under development in cities across Greater China and

Southeast Asia, including a luxury retail centre at Wangfujing in Beijing. In

Singapore, its subsidiary, MCL Land, is a well-established residential

developer. Majority of its assets are investment properties producing recurring

income.The investment thesis for Hongkong Land is almost the same as CapitaLand, at current price, HK Land is trading at huge discount to its book value of more than 50%, dividend yield of about 2.7%.

3. Fufeng Group

Increased position.

The share price had experienced quite a bit of volatility at the beginning of Jan, which may be due to the raise in corn prices in China since last quarter. There were reports that the China state grains stockpiler had started to sell corns from its stockpiles to meet demands and also China imports from USA and Ukraine, and this could moderate the price increase.

As corn is the major cost component in Fufeng's business, it is worthwhile to keep a close tab on its market outlook.

3. Hopefluent

Taken partial profits.

In late Jan, Hopefluent announced a Framework agreement with another large SSE listed property co, Poly Real Estate Group (RMB201B mrk cap) with both companies transferring their the primary & secondary real estate agency business to a new JV. Under the Framework, Hopefluent shall hold 55 - 65% of the JV and Hopefluent shall issue 5% new shares to this partner at HK$4.20 to strengthen the cooperation. This agreement is still subject to the completion of due diligence expected by May 18.

My initial thoughts

1. There is potentially more primary business from new property launches from this big property developer

2. Removed direct competition in the primary and secondary real estate agencies with Poly Real Estate Group upon completion of the deal

3. Hopefluent will be flooded with even more cash from this new share issuance!

In late Jan, Hopefluent announced a Framework agreement with another large SSE listed property co, Poly Real Estate Group (RMB201B mrk cap) with both companies transferring their the primary & secondary real estate agency business to a new JV. Under the Framework, Hopefluent shall hold 55 - 65% of the JV and Hopefluent shall issue 5% new shares to this partner at HK$4.20 to strengthen the cooperation. This agreement is still subject to the completion of due diligence expected by May 18.

My initial thoughts

1. There is potentially more primary business from new property launches from this big property developer

2. Removed direct competition in the primary and secondary real estate agencies with Poly Real Estate Group upon completion of the deal

3. Hopefluent will be flooded with even more cash from this new share issuance!

The market got excited on this news in the next trading day and the share price jumped more than 12% to as high as HK$4.60 before closing at HK$4.16.

While the ex-cash valuation of Hopefluent at current price is still not demanding, the exposure to property sector in this portfolio has increased substantially after adding CapitaLand and Hongkong Land and I deemed an adjustment was necessary. Therefore, I took the opportunity of share price spike to realize some profits on this investment made in Aug-Sep 17, netting an average gain of more 30% (or than more than 60% gain on an annualized basis), not counting the dividend received.

While the ex-cash valuation of Hopefluent at current price is still not demanding, the exposure to property sector in this portfolio has increased substantially after adding CapitaLand and Hongkong Land and I deemed an adjustment was necessary. Therefore, I took the opportunity of share price spike to realize some profits on this investment made in Aug-Sep 17, netting an average gain of more 30% (or than more than 60% gain on an annualized basis), not counting the dividend received.

(Refer to previous postings on this company HERE)

News Review for the rest of Portfolio companies during the month:

Goldpac:

Readers might recall that I had written about Goldpac being hit by exchange losses due to currency translation of its huge USD balance as RMB strengthened against USD during the half year period end Jun 2017.

In the previous financial year, it was reported that approximately 49% of Goldpac's huge cash hoards were in USD & HKD.

If its currency exposure remained the same without hedging done, with continue weakening of USD (note that HKD is also pegged to the USD) since Jun 17, it should not be a surprise that Goldpac would suffer greater exchange losses in the 2nd half period as USD continued to weaken against CNY

In Jan 18, Goldpac was honored with "Best Value TMT Company” for Golden HK Stock Award, 2017.

Goldpac:

Readers might recall that I had written about Goldpac being hit by exchange losses due to currency translation of its huge USD balance as RMB strengthened against USD during the half year period end Jun 2017.

In the previous financial year, it was reported that approximately 49% of Goldpac's huge cash hoards were in USD & HKD.

If its currency exposure remained the same without hedging done, with continue weakening of USD (note that HKD is also pegged to the USD) since Jun 17, it should not be a surprise that Goldpac would suffer greater exchange losses in the 2nd half period as USD continued to weaken against CNY

In Jan 18, Goldpac was honored with "Best Value TMT Company” for Golden HK Stock Award, 2017.

(Refer to previous postings on this company HERE)